Introduction: Why Financial Management Matters for Pet Supply Businesses 🐾

Hey there, fellow pet lovers! 🐶🐱 If you’re like me, you probably started your pet supply business because of your passion for animals. I mean, who wouldn’t want to spend their days surrounded by adorable furballs and wagging tails? But, as I’ve noticed, running a successful pet supply business is about more than just cuddles and cute Instagram posts. The truth is, financial management plays a crucial role in ensuring your business thrives.

Interestingly enough, many pet supply business owners overlook the importance of financial management, focusing solely on sales and customer service. But let me tell you, mastering your finances can be the difference between a thriving business and one that’s struggling to make ends meet. That’s when I realized the power of good financial management in my own life.

So, let’s dive into this comprehensive course on financial management for pet supply businesses. We’ll explore why it’s essential, the challenges you might face, and how to overcome them. Plus, I’ll share some tips and tricks that have worked wonders for me. Ready? Let’s get started!

The Importance of Financial Management: Setting the Foundation

Understanding Your Financial Landscape

Imagine if you were setting off on a road trip without a map or GPS. Sounds chaotic, right? That’s what running a business without understanding your financial landscape feels like. One thing I’ve learned is that having a clear picture of your finances is like having a roadmap to success.

Key Financial Statements

To put it simply, there are three key financial statements you need to be familiar with:

- Income Statement: This shows your revenue, expenses, and profits over a specific period. It’s like a report card for your business’s financial performance.

- Balance Sheet: This provides a snapshot of your business’s assets, liabilities, and equity at a particular point in time.

- Cash Flow Statement: This tracks the flow of cash in and out of your business. It’s crucial for ensuring you have enough cash to cover your expenses.

Budgeting and Forecasting: Planning for the Future

In my opinion, budgeting and forecasting are the backbone of financial management. It’s funny how many business owners shy away from this, thinking it’s too complicated. But, speaking from experience, it’s not as daunting as it seems.

Creating a Budget

Here’s a story: When I first started my pet supply business, I had no budget. I was just thinking I’d figure things out as I went along. Big mistake! I quickly realized the importance of having a budget to track my income and expenses. Here’s a simple way to create one:

- List Your Income Sources: This includes sales, services, and any other revenue streams.

- Track Your Expenses: Categorize your expenses into fixed (rent, salaries) and variable (inventory, marketing).

- Set Financial Goals: Determine your financial goals, such as increasing sales by 10% or reducing expenses by 5%.

Forecasting

Forecasting is like looking into a crystal ball for your business. It helps you predict future income and expenses based on historical data. If you’re like me and love using tools, there are plenty of software options available to make this process easier.

Common Financial Challenges and How to Overcome Them

Cash Flow Management: Keeping the Lifeblood of Your Business Flowing

You won’t believe how many businesses struggle with cash flow issues. The reality is, even profitable businesses can face cash flow problems. I for example, had a month where sales were booming, but my cash flow was tight because of delayed payments from customers.

Tips for Managing Cash Flow

- Invoice Promptly: Don’t delay sending out invoices. The sooner you invoice, the sooner you get paid.

- Offer Payment Incentives: Encourage early payments by offering discounts.

- Monitor Cash Flow Regularly: Keep a close eye on your cash flow statement to spot any potential issues early on.

Inventory Management: Striking the Right Balance

In the pet supply business, inventory management can make or break you. I was struck by how much money I had tied up in unsold inventory at one point. It’s clear that finding the right balance is crucial.

Effective Inventory Management Strategies

- Use Inventory Management Software: This helps you track stock levels, sales, and orders in real-time.

- Implement Just-In-Time Inventory: This strategy reduces excess inventory by ordering stock only when needed.

- Regularly Review Inventory Levels: Conduct regular audits to ensure you’re not overstocked or understocked.

Managing Debt: Staying on Top of Your Obligations

Debt can be a double-edged sword. It can help you grow your business, but it can also become a burden if not managed properly. In my own life, I’ve seen how easy it is to let debt spiral out of control.

Tips for Managing Debt

- Prioritize High-Interest Debt: Focus on paying off high-interest debt first to save on interest costs.

- Consolidate Debt: If you have multiple debts, consider consolidating them into a single loan with a lower interest rate.

- Negotiate with Creditors: Don’t be afraid to negotiate better terms with your creditors.

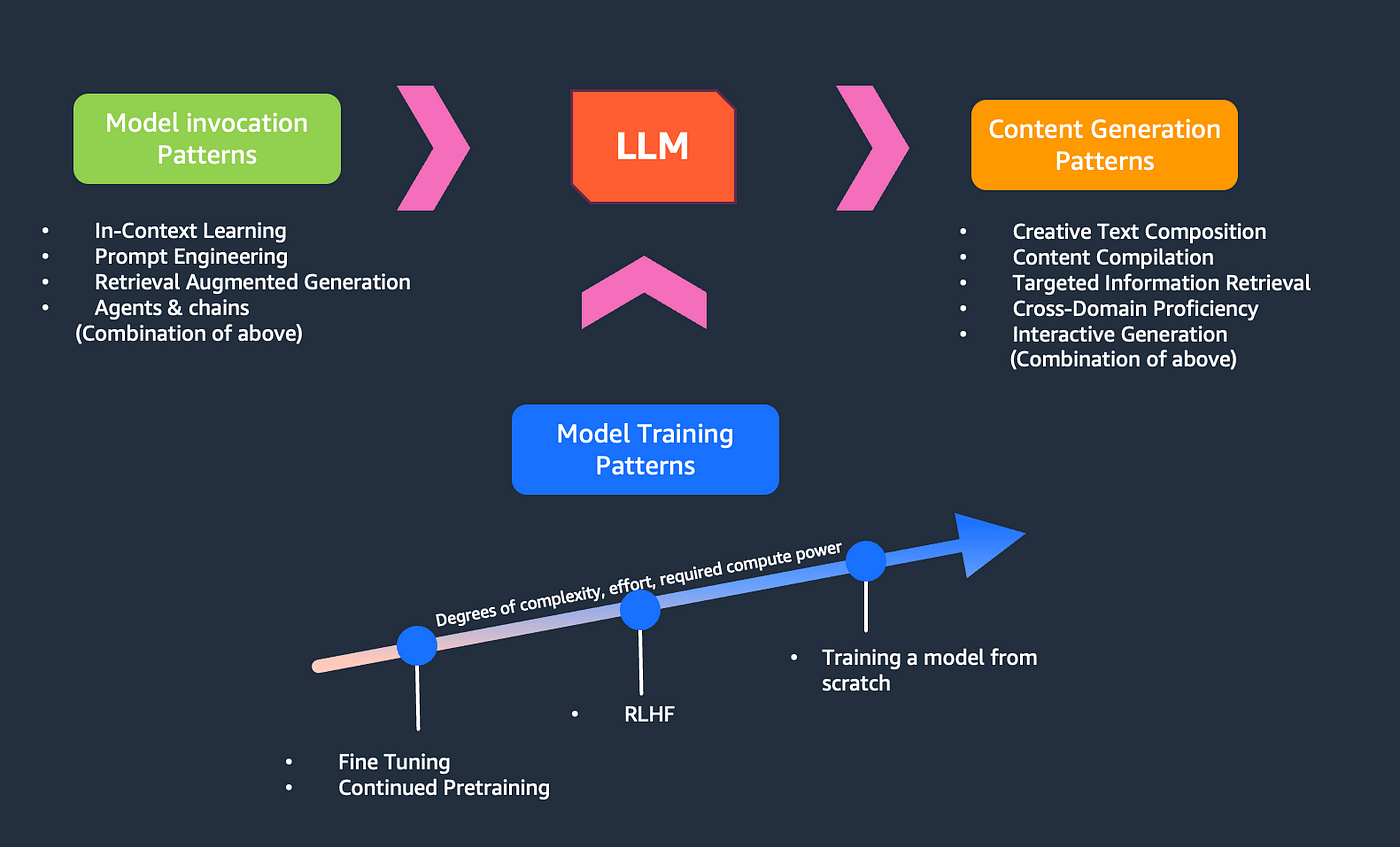

Leveraging Technology for Financial Management: Tools and Resources

Accounting Software: Your New Best Friend

If you’re like me and not a fan of manual bookkeeping, accounting software can be a game-changer. I guess you could say it’s a lifesaver for small business owners.

Popular Accounting Software Options

- QuickBooks: Great for small to medium-sized businesses.

- Xero: Known for its user-friendly interface and robust features.

- Wave: A free option that’s perfect for startups and small businesses.

Financial Planning Tools: Making Life Easier

Financial planning tools can help you with budgeting, forecasting, and tracking your financial goals. Here’s a funny thing: I used to rely on spreadsheets for everything until I discovered these tools.

Recommended Financial Planning Tools

- Mint: Great for budgeting and tracking expenses.

- YNAB (You Need A Budget): Helps you create a detailed budget and stick to it.

- PlanGuru: Ideal for advanced budgeting and forecasting.

Real-Life Success Stories: Lessons from the Trenches

Story 1: Turning Around a Struggling Business

Here’s a story of a friend who was struggling with her pet supply business. She was passionate about pets but had no clue about financial management. That’s when I realized the importance of sharing my knowledge with others.

Key Takeaways

- Understand Your Financial Statements: She learned to read and understand her financial statements, which gave her a clear picture of her business’s health.

- Create a Budget: By creating a budget, she was able to control her expenses and allocate resources more effectively.

- Manage Cash Flow: She implemented cash flow management strategies, which helped her avoid cash shortages.

Story 2: Scaling Up Successfully

Another friend of mine had a successful pet supply business but wanted to scale up. I was just thinking about how scaling can be tricky without proper financial management.

Key Takeaways

- Forecasting: He used forecasting to predict future sales and expenses, which helped him plan for growth.

- Inventory Management: By implementing inventory management software, he was able to keep track of stock levels and avoid overstocking.

- Debt Management: He consolidated his debts, which reduced his interest costs and freed up cash for expansion.

Actionable Steps: Taking Your Pet Supply Business to the Next Level

Step 1: Educate Yourself

It’s common knowledge that knowledge is power. Take the time to educate yourself about financial management. There are plenty of online courses, books, and resources available.

Step 2: Implement Financial Management Tools

Invest in accounting software and financial planning tools. These tools will save you time and make financial management easier.

Step 3: Monitor Your Finances Regularly

Regularly review your financial statements, budget, and cash flow. This will help you spot any issues early on and take corrective action.

Step 4: Seek Professional Help

If you’re struggling with financial management, don’t hesitate to seek professional help. A financial advisor or accountant can provide valuable insights and guidance.

Step 5: Stay Committed

Financial management is an ongoing process. Stay committed to managing your finances, and you’ll see the benefits in the long run.

Wrapping Up: Embrace Financial Management for Success 🎉

Looking back, I can’t forget the challenges I faced when I first started my pet supply business. But it hit me that mastering financial management was the key to overcoming those challenges and achieving success. As I see it, financial management is not just about numbers; it’s about making informed decisions that drive your business forward.

So, if you’re like me and passionate about your pet supply business, embrace financial management. It’s safe to say that with the right tools, strategies, and mindset, you can take your business to new heights. Remember, the thing is, financial management is your roadmap to success. Happy managing! 🐾💰

Feel free to share your thoughts, experiences, or any questions you have in the comments below. Let’s help each other succeed in this wonderful journey of running a pet supply business! 🐶🐱

For additional resources, check out these links:

Note: This blog post is for informational purposes only and does not constitute financial advice. Always consult with a professional for financial matters.